- المنتجات المعدنية منتجات الألومنيوم منتجات النحاس المنتجات المطلية بالمعادن المنتجات الفولاذية المقاومة للصدأ منتجات الفولاذ الكربوني خلط المعادن الخاص

- المشاريع لوحة الحواجز الفولاذية رف الخزانة الهياكل الفولاذية الجسر الفولاذي السقالة المواد الإنشائية المواد الخام الكيميائية One Stop Solutions for Projects

- الحاويات الحاويات القياسية لـ ISO الحاويات للمعدات الحاويات للتخزين والنقل دار الحاويات الحاويات المثلجة الحاويات القريبة السواحل

- الماكينات آلة تشكيل المعادن الآلات الأخرى آلة قطع المعادن آلة تصنيع المعادن آلة التعويج آلة تصنيع البلاط

- منتجات الماكينات صناعة السيارات المنوعات معدات الإرساء معدات السفينة أناء الضغط

- النظام الكهرباء والميكانيكي الكابل الكهربائي الأوتوماتيكي التنسيق الكهربائي نظام طاقة الشمس نظام حماية أمن الكهرباء آلة التحويل خط الأنتاج نظام الإضاءة

- المعدات الطبية منتجات الإطعام منتجات أنبوب إدخال القصبة الهوائية منتجات الرعاية المنتجات البلاسبيكية

- epc مشاريع

- آلات البناء

- خط أنابيب النفط

- خط أنابيب المياه

- انبوب الغاز

- مستلزمات السفن والرباط

- المعادن للزخرفة/ للديكور

- مكونات المحولات

- أنابيب التبادل الحراري

- قطع غيار تكييف الهواء ومستلزماته

- سخان مياه

- أدوات المطبخ و الحمام

- المعادن للأجهزة المنزلية

- أجهزة الطاقة الشمسية

- المصعد الكهربائي

- الأسطح والأسقف

- الكابلات

- الخزانات

- التعبئة والتغليف

- قطع غيار الآلات والمعدات ومستلزماته

- القوالب

- قطع غيار السيارات

- السكك الحديدية و رافعات السكك الحديدية

- تركيب الأجهزة

- الكاشطة

- معدات بناء الطرق

- المكونات الإلكترونية

- اعمال البناء ومواد الديكور

- الأبواب والنوافذ

- الثلاجات

Short overview of ArcelorMittal annual report

Business overview

Europe’s operating loss for the year ended December 31, 2013 also included impairment charges of $86 million, of which $55 million was in connection with the long-term idling of the ArcelorMittal Tallinn galvanizing line in Estonia, largely offset by the reversal of an impairment loss of $52 million at the Liège site of ArcelorMittal Belgium following the restart of the hot dip galvanizing line HDG5, $24 million primarily related to the closure of the organic coating and tin plate lines at the Florange site of ArcelorMittal Atlantique et Lorraine in France and included an impairment charge of $41 million with respect to the subsidiaries included in the agreed sale of certain steel cord assets in the US, Europe and Asia to the joint venture partner Kiswire Ltd.

Net Cash Used in Investing Activities

ArcelorMittal’s major capital expenditures in the year ended December 31, 2014 included the following major projects: Liberia greenfield mining project; capacity expansion in finished products, wire rod production expansion in Monlevade; rebar and meltshop expansion in Juiz de Fora; construction of a new rolling mill in Acindar and construction of a heavy gauge galvanizing line to optimize galvanizing operations in ArcelorMittal Dofasco.

Acquisitions and divestments

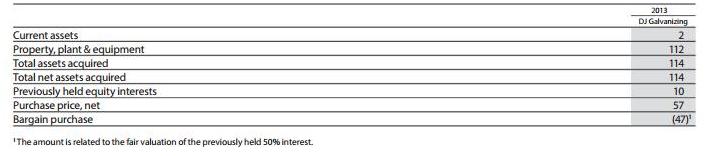

DJ Galvanizing On January 11, 2013, ArcelorMittal acquired control of the joint operation DJ Galvanizing, a hot dip galvanizing line located in Canada, through the acquisition of the 50% interest held by the other joint operator. The total consideration paid was 57. The Company recognized in cost of sales a gain of 47 relating to the fair valuation of the previously held 50% interest. DJ Galvanizing is part of the NAFTA reportable segment. The revenue and the net result consolidated in 2013 and 2014 amounted to 21 and 27 and (3) and (2) respectively.

Summary of significant acquisitions

According to ArcelorMittal, the table below summarizes the estimated fair value of the assets acquired and liabilities assumed and the total purchase price allocation for significant acquisitions made in 2013: