- المنتجات المعدنية منتجات الألومنيوم منتجات النحاس المنتجات المطلية بالمعادن المنتجات الفولاذية المقاومة للصدأ منتجات الفولاذ الكربوني خلط المعادن الخاص

- المشاريع لوحة الحواجز الفولاذية رف الخزانة الهياكل الفولاذية الجسر الفولاذي السقالة المواد الإنشائية المواد الخام الكيميائية One Stop Solutions for Projects

- الحاويات الحاويات القياسية لـ ISO الحاويات للمعدات الحاويات للتخزين والنقل دار الحاويات الحاويات المثلجة الحاويات القريبة السواحل

- الماكينات آلة تشكيل المعادن الآلات الأخرى آلة قطع المعادن آلة تصنيع المعادن آلة التعويج آلة تصنيع البلاط

- منتجات الماكينات صناعة السيارات المنوعات معدات الإرساء معدات السفينة أناء الضغط

- النظام الكهرباء والميكانيكي الكابل الكهربائي الأوتوماتيكي التنسيق الكهربائي نظام طاقة الشمس نظام حماية أمن الكهرباء آلة التحويل خط الأنتاج نظام الإضاءة

- المعدات الطبية منتجات الإطعام منتجات أنبوب إدخال القصبة الهوائية منتجات الرعاية المنتجات البلاسبيكية

- epc مشاريع

- آلات البناء

- خط أنابيب النفط

- خط أنابيب المياه

- انبوب الغاز

- مستلزمات السفن والرباط

- المعادن للزخرفة/ للديكور

- مكونات المحولات

- أنابيب التبادل الحراري

- قطع غيار تكييف الهواء ومستلزماته

- سخان مياه

- أدوات المطبخ و الحمام

- المعادن للأجهزة المنزلية

- أجهزة الطاقة الشمسية

- المصعد الكهربائي

- الأسطح والأسقف

- الكابلات

- الخزانات

- التعبئة والتغليف

- قطع غيار الآلات والمعدات ومستلزماته

- القوالب

- قطع غيار السيارات

- السكك الحديدية و رافعات السكك الحديدية

- تركيب الأجهزة

- الكاشطة

- معدات بناء الطرق

- المكونات الإلكترونية

- اعمال البناء ومواد الديكور

- الأبواب والنوافذ

- الثلاجات

3 Reasons Why Steel Prices Will Rise Well Into 2017

1. Trump Wins: Investors Bet On Steel Companies

What changes in the steel industry Donald Trump will make are still unknown. What’s clear is that the new president-elect made trade, manufacturing and the steel industry

a cornerstone of his agenda.

Stocks of American steel companies soared last week as investors hope that a Trump-led government will boost domestic infrastructure, which could be a boom for steel

demand. In addition he has stated he would institute more measures to protect domestic steel producers.

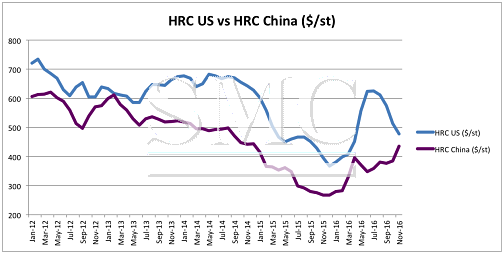

A good benchmark for steel prices is the Dow Jones US Steel Index, which tracks major steel producers around the globe. Following the election, the index rose sharply

to the highest levels in two years. The stocks of US steel companies are linked to domestic steel prices. This powerful price increase hints to a rebound in steel prices.

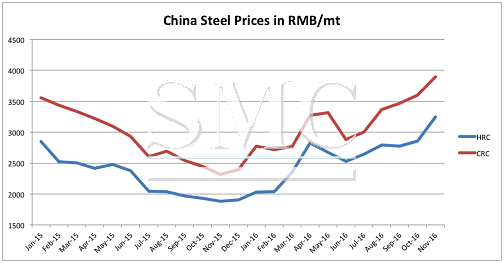

2. Rising Chinese Steel Prices

Chinese demand from infrastructure and construction has been robust this year. So has its auto sector, a key industry for steel demand. The Caixin manufacturing PMI

for October rose to 51.2, the highest reading since July 2014 and betting market expectations. Vehicle sales in China increased 27% year on year in September,

reaching the highest figure so far this year.

3. Industrial Metals Booming

Another reason to expect a rebound in steel prices is the ongoing price strength across the metal complex. We are witnessing powerful moves across the board.

Even copper, a metal whose fundamentals didn’t look appealing, recently rose near 20% in a matter of days. The bullish sentiment across base metals is another

reason the expect a rebound in steel prices.

When To Buy Steel?

Earlier this year, steel buyers had a good opportunity to lock in purchases at low prices. We expect to see another good opportunity to buy steel soon.

Steel buyers need to closely monitor domestic prices, to understand the right time to hedge/buy forward.